Vancouver, BC – 1 August, 2018 – Aftermath Silver Ltd. (AAG.H – TSX-V) (“Aftermath” or the “Company”) is pleased to announce it has entered into a non-binding Letter of Intent (the “LOI”) with Mandalay Resources Inc. (“Mandalay”) to purchase the Challacollo silver-gold project (“Challacollo” or the “Project”) through the purchase of 100% of Mandalay’s shares in the Chilean holding company Minera Mandalay Challacollo Limitada (“MMC”), which currently owns 100% of the Project. Challacollo is the only asset held by MMC.

Challacollo is a low sulphidation epithermal deposit which hosts an historic Mineral Resource of Indicated of 4.7 million tonnes at 200 g/t silver and an Inferred of 1.6 million tonnes at 134 g/t silver, with associated gold credits. Drilling has defined the historic mineral resources on the principal vein (Lolón Vein) to a depth of approximately 200 m below surface, the Company will focus efforts on parallel vein systems, not included in the mineral resource that have some preliminary drilling.

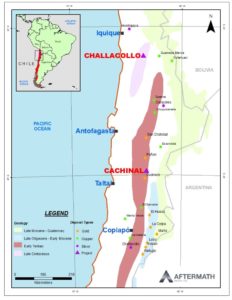

Mr. Sean Hurd, President and CEO of the Company, commented “The acquisitions of the high grade Challacollo project and the recently announced Cachinal silver-gold project drives Aftermath into the upper ranks of silver dominant developers, with pro-forma total silver ounces of 48.6 million tonnes Indicated Mineral Resources at 146 g/t and 9.9 million tonnes Inferred Mineral Resource at 128 g/t. The Company believes both projects have significant upside potential and will now prepare plans to drill both projects. The Company has focused efforts on Chile, a highly ranked mining jurisdiction, which the Company believes provides significant advantages over other Latin American countries but has been overlooked for its silver potential in recent years.”

Material Terms of the Acquisition

The Company will pay Mandalay the following consideration for MMC:

- CA$1,000,000 cash on the closing date;

- CA$1,250,000 cash not later than the 18 months following the closing date; and

- CA$1,500,000 cash upon the first to occur of (i) completion of a NI 43-101 technical report of either a mineral resource of not less than 50M silver equivalent ounces, (ii) a NI 43-101 feasibility study and (iii) 18 months from the date of granting of the Environmental Assessment Decision (“Resolución de Calificación Ambiental”) associated with the environmental assessment process that is currently in progress for the execution of a drilling campaign at the Project;

- CA$7,875,000 cash or the equivalent value in Aftermath shares (based on the trading price of Aftermath shares at the time of the payment) not later than November 30, 2019, provided that in no event shall the number of Aftermath shares issued represent more than 49% of Aftermath’s outstanding shares following such payment.

The closing of the acquisition is subject to a number of conditions precedent, including execution of a definitive agreement, approval of the Acquisition by the shareholders of Aftermath, and TSX Venture Exchange approval and the receipt of all necessary third party consents.

In connection with the acquisition, Aftermath will assume Mandalay’s existing contingent share and silver delivery payment obligations with respect to the Project under the terms of a share purchase agreement dated December 19, 2013 among Silver Standard Resources Inc. (“SSRI”), Silver Standard Ventures Inc. (“SSVI”), Mandalay and Mandalay Resources (Chile) SPA and other existing royalties.

In connection with the acquisition, Aftermath and Mandalay will enter into an investor rights agreement pursuant to which Mandalay will have the right to participate in future equity offerings by Aftermath in order to maintain its pro rata ownership interest and, for as long as Mandalay owns at least 10% of Aftermath’s outstanding shares, to nominate one member of Aftermath’s board of directors. Aftermath will have a right of first refusal to direct the disposition of any Aftermath shares that Mandalay proposes to sell for as long as Mandalay owns at least 20% of Aftermath’s outstanding shares.

A finder’s fee in favour of Elysium Mining Ltd, is payable with each payment to Mandalay. The finder’s fee is subject to TSX-V rules and limitation ranges and will be paid in cash and shares.

Overview of the Challacollo Silver-Gold Project

The following information (and other historic mineral resource information set out in this press release with respect to the Project) is based on a technical report in respect of the Project prepared for MMC by Mining Plus entitled “NI 43-101 Technical Report for the Challacollo Silver Project, Region 1, Chile” and dated March 31, 2015 (the “Mining Plus Report”). The Mining Plus Report is available under Mandalay’s SEDAR profile at www.sedar.com. An independent “Qualified Person”, as defined in National Instrument 43-101 (“NI 43-101”), has not done sufficient work on behalf of Aftermath to classify the historical estimate as a current indicated mineral resource or inferred mineral resource, and Aftermath is not treating the historical estimate as a current mineral resource. Further work must be completed in order to demonstrate whether a reasonable expectation for commercial extraction exists. The mineral resource estimate is a historical estimate and should not be relied upon.

The Challacollo Silver-Gold Project is located in Chile’s Tarapaca Region (Region I), 130 km southeast of the major port city of Iquique and 50 km south of the town of Pica. The project is located approximately 30 km east of the Pan American Highway, via Teck Resources’ Quebrada Blanca Copper Mine access road, before turning onto a gravel track for 20 km. Travel time from Iquique airport is 1.5 hours.

Power transmission lines are located 15-30 km from the property, in part to service nearby mines of Collahuasi and Quebrada Blanca. The Project includes water rights.

Silver-gold-zinc mineralization at Challacollo occurs in a cluster of sub-parallel, low-sulphidation epithermal quartz veins and brecciated structures hosted in the Late Cretaceous Challacollo Volcanic Complex comprising rhyolites of various types. There are four main north to northeast trending veins that pinch and swell following north-south trending faults in the property area – the Lolón, Palermo, Gladys 4, and Gladys 1. Most of the previous exploration and mining activities on the Property have been carried out on the Lolón Vein, the Mineral Resource estimate (see the Table above) includes only the Lolón vein.

Mining has occurred at Challacollo since 1770, principally from 1896 to 1931 when low silver prices resulted in closure. Illegal artisanal miners were mining intermittently up to 1980 when the then owner reasserted legal claims and mined until the early 1990’s. Modern exploration has occurred in several programs starting in 1995. The underground drives were accessed and sampled by Silver Standard in 2001 and Mandalay in 2014.

The oxidation level bottoms at approximately 200 m below surface; however, the down dip extent of the mineralized structures remains unknown. Gold and base metal grades increase at depth.

Historic December 2014 Challacollo Ag-Au Deposit Mineral Resource Estimate, (see below for details)

| Resource Classification | Quantity (Mt) | Grade | Contained Metal | ||

| Silver (g/t) | Gold (g/t) | Silver (Moz) | Gold (Koz) | ||

| Indicated | 4.70 | 200 | 0.32 | 30.2 | 48.4 |

| Inferred | 1.60 | 134 | 0.31 | 6.9 | 15.9 |

Notes on the Mineral Resource Estimate set out in the Mining Plus Technical Report:

- The Mineral Resource has been prepared by independent qualified persons Marek Mroczek P.Eng., Michael Collins, P.Geo., Seam Butler, P.Geo., of Mining Plus Canada Consultants Ltd and Juan Carlos Tapia of Sedgman S.A., with an effective date of December 31, 2014.

- Mineral Resources stated according to CIM guidelines.

- Mineral Resources are estimated at a cut-off grade of 60 g/t Ag.

- Mineral Resources are estimated using a silver price of US$24/oz, a gold price of US$1,400 per ounce, metallurgical recoveries of 92% for silver and 75% for gold, and operating costs of US$50 per tonne.

- A density of 2.45 g/cm3 is used as a base density with adjustments according to the variation of the estimated barium, lead and zinc grades.

- No capping of Ag grades has been applied due to low grade variability. Au grades have been capped at 3 g/t for two sample composites 4.57 g/t Au and 4.11 g/t Au respectively.

- QA-QC details can be found in the NI 43-101 Technical Report, filed under Mandalay Resources profile on SEDAR.

- To the knowledge of Aftermath Silver, there is no new data available since the calculation of the above historical resource estimate and no additional work has been done to upgrade or verify the historical resource estimate;

Private Placement

The Company previously announced an equity financing of not less than C$5 million (the “Financing”) to fund transaction costs of the Cachinal, this has been increased to C$7 million to fund the acquisition of MMC and initial exploration expenditures on the Project. The terms of the Financing will be determined in the context of the market and will be announced at a later date. Completion of the Financing is subject to acceptance by the TSX Venture Exchange.

Qualified Person

Peter Voulgaris, MAIG, MAusIMM, is a non-independent qualified person as defined by NI 43-101. Mr. Voulgaris has reviewed the technical content of this press release, and consents to the information provided in the form and context in which it appears.

About Mandalay Resources Corporation

Mandalay Resources is a Canadian-based natural resource company with producing assets in Australia and Sweden, and care and maintenance and development projects in Chile. Mandalay is focused on executing a roll-up strategy, creating critical mass by aggregating advanced or in production gold, copper, silver and antimony projects in Australia, the Americas, and Europe to generate near-term cash flow and shareholder value.

About Aftermath Silver Ltd

Aftermath Silver Ltd is a Canadian junior exploration company engaged in acquiring, exploring, and developing mineral properties with an emphasis on silver in Chile. The Company is focused of growth through the discovery and acquisition of quality projects in stable jurisdictions. Aftermath continues to seek new opportunities to take advantage of the relatively low silver price.

Map of the Mineral Belts in Northern Chile and the locations of Challacollo and Cachinal Silver-Gold Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

“Sean Hurd”

Sean Hurd President & CEO

Forward Looking Statements

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Certain statements within this news release, other than statements of historical fact relating to Aftermath Silver, are to be considered forward-looking statements with respect to the Company’s intentions for the Cachinal Project in Chile. Forward-looking statements include statements that are predictive in nature, are reliant on future events or conditions, or include words such as “expects”, “potential”, “anticipates”, “plans”, “believes”, “considers”, “significant”, “intends”, “targets”, “estimates”, “seeks”, attempts”, “assumes”, and other similar expressions.

The forward-looking statements are based on a number of assumptions which, while considered reasonable by Aftermath Silver Ltd, are, by their nature, subject to inherent risks and uncertainties and are not guarantees of future performance. Factors that could cause actual results to differ materially from those in forward-looking statements include: the interpretation of previous and current results, the accuracy of exploration results, the accuracy of Mineral Resource Estimates, the anticipated results of future exploration, the forgoing ability to finance further exploration, delays in the completion of exploration, the future prices of silver and gold, and other metals, and general economic, market and/or business conditions. There can be no assurances that such statements and assumptions will prove accurate and, therefore, readers of this news release are advised to rely on their own evaluation of the information contained within. In addition to the assumptions herein, these assumptions include the assumptions described in Aftermath Silver Ltd’s Management’s Discussion and Analysis for the nine months ended February 28, 2018.

Although Aftermath Silver Ltd. has attempted to identify important risks, uncertainties and other factors that could cause actual performance, achievements, actions, events, results or conditions to differ materially from those expressed in or implied by the forward-looking statements, there may be other risks, uncertainties and other factors that cause future performance to differ from what is anticipated, estimated or intended. Unless otherwise indicated, forward-looking statements contained herein are as of the date hereof and Aftermath Silver Ltd. does not assume any obligation to update any forward-looking statements after the date on which such statements were made, except as required by applicable law.