84% of Indicated and Inferred Resources within Conceptual Pit Shell

Vancouver, BC, December 15, 2020 – Aftermath Silver Ltd. (the "Company" or "Aftermath Silver") (TSX-V: AAG) (OTCQB: AAGFF) is pleased to provide the results of a CIM compliant Mineral Resource estimate for the Challacollo silver-gold project, in Region 1 of northern Chile, summarised in Table 1.

The Mineral Resource estimate used a conceptual open pit and underground optimised shapes to constrain the estimate.

Table 1. Summary of the Mineral Resource Estimate for the Challacollo Silver-Gold Project

|

Classification |

Material |

Tonnes (Kt) |

Silver (g/t) |

Gold (g/t) |

Silver |

Gold (Koz) |

|

Indicated |

Open Pit |

5,597 |

170 |

0.27 |

30,639 |

49 |

|

Underground |

1,043 |

134 |

0.29 |

4,510 |

10 |

|

|

TOTAL |

6,640 |

165 |

0.27 |

35,150 |

58 |

|

|

Inferred |

Open Pit |

2,360 |

117 |

0.15 |

8,912 |

11 |

|

Underground |

443 |

157 |

0.26 |

2,232 |

4 |

|

|

TOTAL |

2,803 |

124 |

0.17 |

11,144 |

15 |

Source: AMC Mining Consultants (Canada) Ltd, (2020)

Notes on the Challacollo Mineral Resource Estimate

- CIM Definition Standards (2014) were used for reporting the Mineral Resources.

- The effective date of the estimate is 30 November 2020.

- The Qualified Person is Dinara Nussipakynova, P.Geo., of AMC Mining Consultants (Canada) Ltd.

- Mineral Resources are constrained by an optimized pit shell at a long-term metal price of US$20/oz Ag with recovery of 92% Ag and metal price of US$1,400/oz Au with recovery of 75%.

- Silver equivalency formula is AgEq (g/t) = Ag (g/t) + 57.065 *Au (g/t).

- The open pit mineral resources are based on a pit optimization using the following assumptions:

- Plant feed mining costs of US$3.5/t and waste mining cost of $2.5/t.

- Processing costs of US$17/t and General and Administration costs of $2.5/t.

- Edge dilution of 7.5% and 100% mining recovery.

- 45-degree slope angles

- Cut-off grade is 35 g/t AgEq g/t.

- The underground mineral resources are reported within Datamine MSO stopes based on the following assumptions:

- Mining costs of US$35/t.

- Processing costs of US$17/t and General and Administration costs of US$2.5/t.

- Minimum width of 2.5 m

- No dilution or mining recovery.

- Cut-off grade is 93 AgEq g/t

- Bulk density used was 2.47 t/m3

- Drilling results up to 31 December 2016.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The numbers may not compute exactly due to rounding.

- Mineral Resources are depleted for historic mined out material.

Further details supporting the geological model, estimation procedure, sampling and metallurgical testwork will be available in a NI 43-101 technical report. The technical report will be posted under the Company's profile at www.sedar.com, the report is well advanced and is expected to be filed on SEDAR in within four weeks.

Ralph Rushton, President and CEO of the Company, commented "We are extremely pleased with the results of this Mineral Resource estimate. For the first time, a significant amount of mineralisation is included from outside of the main Lolón Vein, from veins that are predominately on the hangingwall to the Lolón vein. We believe this validates our concept for the Project, approximately 84% of the Indicated and Inferred resources fall inside the conceptual pit shell. This estimate is only the first step for Aftermath Silver in reaching the Company's ultimate vision for Challacollo, and the whole team is excited to start the program in the new year."

Resource Estimate Details

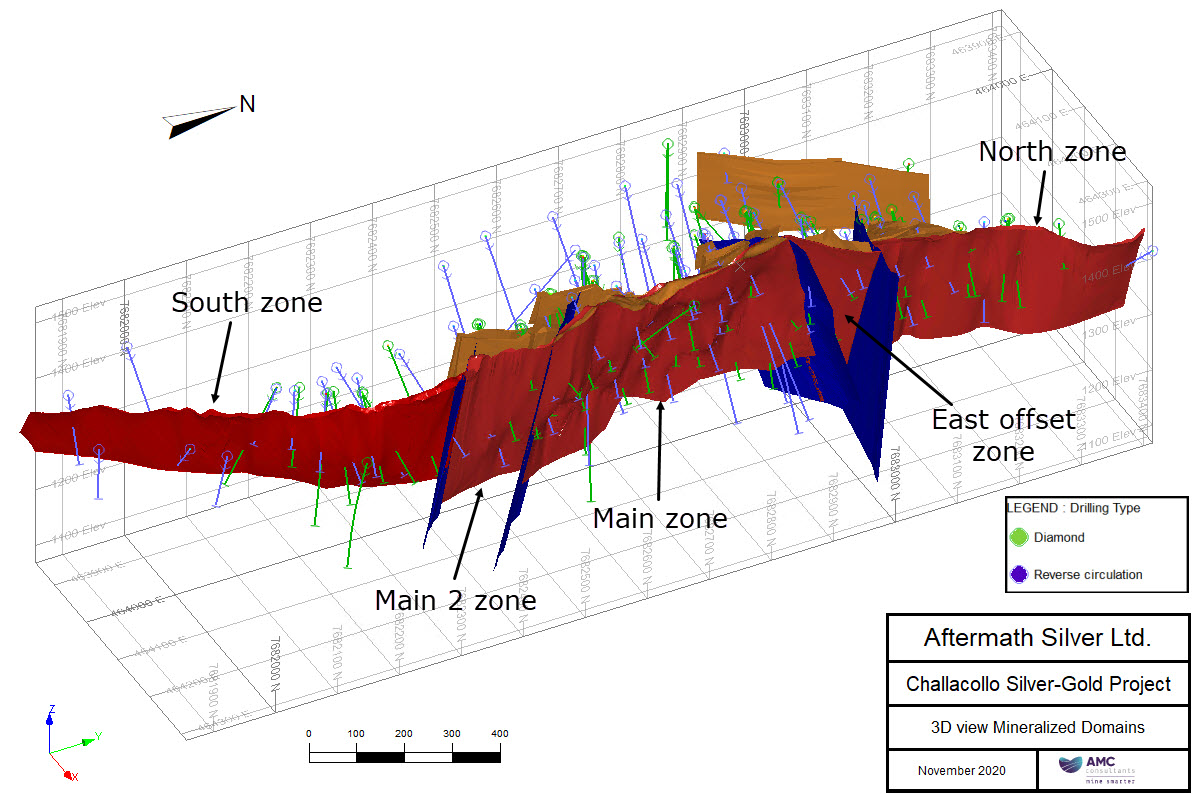

The resource estimate is based on a geological model that utilised the geological logging and assaying of drilling as well as detailed surface mapping. A mineralised domain wireframe for the Lolón Structure was constructed by Aftermath and reviewed by the independent Qualified Person (QP). The other mineralised domains were wireframed by the QP. The mineralized wireframes for the Lolón structure were based on a silver threshold of nominally 60 g/t Ag; this structure is split into the five segments South, Main 2, Main, East Offset, and North zones, separated by fault offsets, as shown in Figure 1. In addition, there are other sub parallel zones for which a 40 g/t Ag threshold was used.

A total of 112 drillholes totalling 19,213 m are located in the block model area consisting of 57 diamond and 55 reverse circulation drillholes, of which 97 drillholes intercepted the interpreted mineralization and are used in the estimate.

The analysis of probability plots of the Ag grades for the domains demonstrated the presence of high-grade outliers in the Lolón structure. Top capping was applied individually to the zones. The top cut value of 1,500 g/t Ag was selected for Lolón Main zone and the other Lolón zones which were individually treated, varied from 800 g/t Au to 190 g/t Ag. No capping was applied to the hanging wall zones.

The mean sample length is 1.38 m and the median 1 m for the entire dataset. The compositing interval was selected as 1 m. Samples were composited by domain as equal length composites with no discards.

The composites of all five zones on the Lolón structure were combined into one file with a total of 1,025 samples. Variograms were produced for Ag and Au grades based on this larger dataset. Two structure spherical variograms were modelled in Datamine.

A block model was generated in Datamine software using 4 m E x 10 m N x 5 m RL parent block size. Sub-blocking was employed and resulted in minimum cell dimensions of 0.1 m E x 1 m N x 0.25 m RL.

The grade estimation was carried out by 3 passes. The grades were estimated for each domain individually. Ordinary kriging (OK) was used for estimating the Lolón structure, but due to the small number of samples inverse distance squared (ID2) was used for the hangingwall zones.

The estimation of the Lolón zones was interpolated using the Dynamic Anisotropy feature in Datamine. Dynamic anisotropy re-orientates the search ellipsoid for each estimated block based on the local orientation of the mineralization.

The block model was validated in four ways. First, visual checks were carried out to ensure that the grades respected the capped and composited assay data. Secondly, swath plots were reviewed. Thirdly, the estimate was statistically compared to the capped assay data, with satisfactory results. Lastly, the estimates were compared to other methods namely ID2, inverse distance cubed, and a nearest neighbour estimate as applicable, also with acceptable results.

Mineral Resource classification was completed using an assessment of geological and mineralization continuity, data quality, and data density. Search passes, different from those used to estimate grade, were used as an initial guide for classification. Wireframes were then generated manually to build coherent volumes defining the different classes.

The model is depleted for historical mining activities, using surveys where available or by removing the full width of the Lolón Structure where no accurate survey was available.

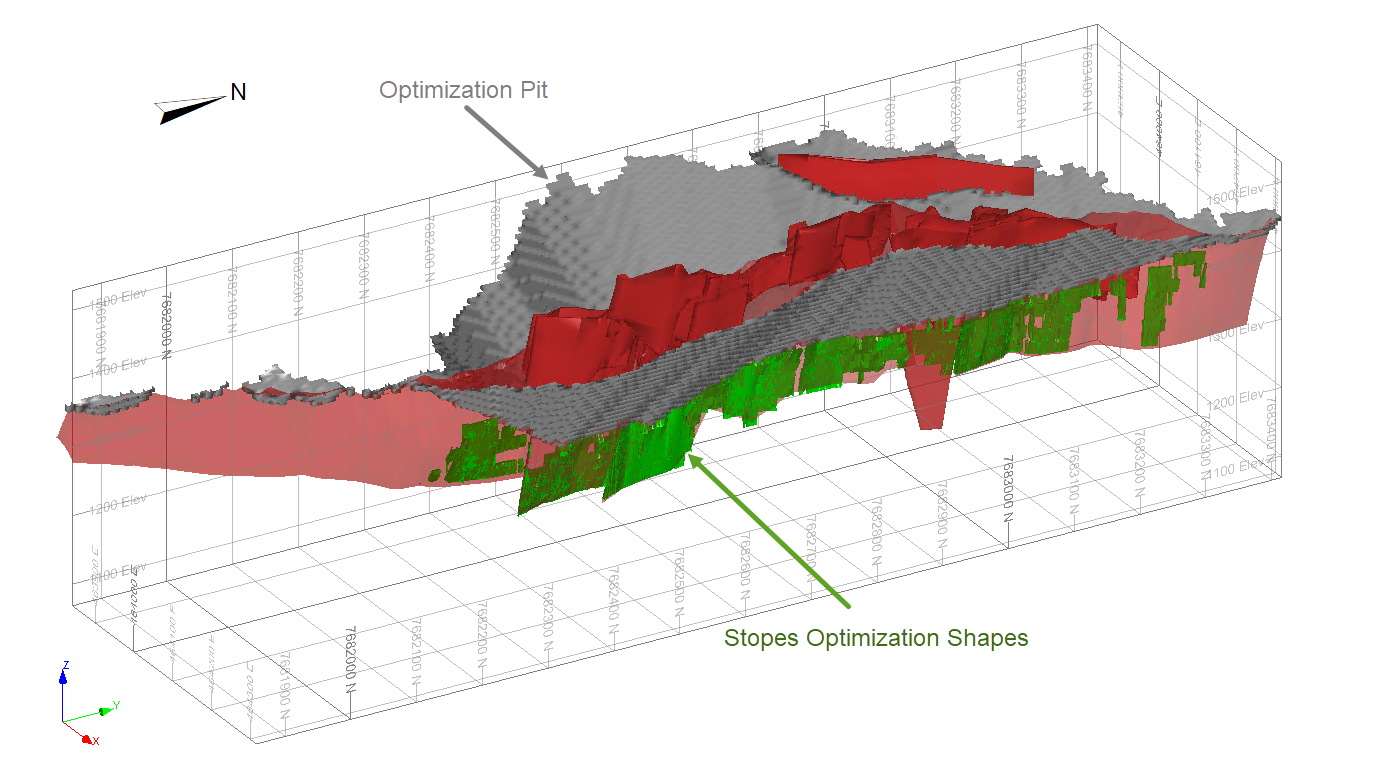

Figure 3 shows a 3D view of the constrained open pit shell Mineral Resources (shown in red) and optimized underground Mineral Resources (shown in green). The maximum depth of the conceptual pit shell is 255 m. The underground conceptual stope shapes lie beneath the pit to a maximum vertical extent of 100 m, to the lower limits of the block model. Isolated stopes were not included in the Mineral Resource.

Data Verification

Qualified Person, Sergio Alvarado Casas, registered member of the Chilean Mining Commission (No. 004), and member of the IIMCh, of Geoinvest SAC E.I.R.L. (Chile) undertook a site visit to Challacollo in September 2020, this included verification of drill collars, storage of drill core and RC sampling.

Qualified Person, Mort Shannon, P.Geo., of AMC Mining Consultants (Canada) Ltd.considers sample preparation, analytical, and security protocols employed by Silver Standard and Mandalay to be acceptable. The QP has reviewed the Quality Assurance and Quality Control (QA/QC) procedures used by these operators including certified reference materials, blanks, duplicates, and umpire data and considers the assay database to be adequate for Mineral Resource estimation.

Qualified Person, Dinara Nussipakynova, P.Geo., of AMC Mining Consultants (Canada) Ltd., is the QP for Mineral Resources and data verification. Data verification included a review of the assay database and collar locations. The QP undertook random cross-checks of assay results in the database with original assay results on the assay certificates returned from ALS Laboratories (Canada), ALS Chemex (Chile) and ALS Mineral (Chile). This verification consisted of comparing 1,210 of the 5,757 assay results in the database to those in the certificates. This is approximately 21% of the total samples. No errors were detected. The QP considers the assay database to be acceptable for Mineral Resource estimation.

Qualified Person, Brendan Mulvihill, MAusIMM Chartered Professional (CP) Metallurgy, of GR Engineering Services is the QP for the review of the metallurgical testwork, and considers the recoveries used to be acceptable for use in the Mineral Resource estimate.

The QPs have identified no known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources.

Figure 1. 3D view of mineralization domains

Figure 2. N-S vertical section with block model classification

Figure 3. 3D view of open pit shell and underground optimized stope solids

Source: AMC Mining Consultants (Canada) Ltd, (2020)

Note: constrained open pit Mineral Resources shown in red, constrained underground Mineral Resources shown in green, the modeled extent of the Lolón Structure is shown in light red.

About Aftermath Silver Ltd

Aftermath Silver Ltd is a Canadian junior exploration company focused on silver, and aims to deliver shareholder value through the discovery, acquisition and development of quality silver projects in stable jurisdictions.

Aftermath has developed a pipeline of projects at various stages of advancement. The Companies projects have been selected based on growth and development potential.

- Berenguela Silver-Copper project. The Company has an option to acquire a 100% interest through a binding agreement with SSR Mining. The project is located in the Department of Puno, in southern central Peru. An NI 43-101 Technical Report on the property is in progress. The company is planning to advance the project through a pre-feasibility study.

- Challacollo Silver-Gold project. The Company has an option to acquire 100% interest in the Challacollo silver-gold project through a binding agreement with Mandalay Resources, see Company news release dated June 27th, 2019. The company will aggressively seek to grow the mineral resource.

- Cachinal Silver-Gold project. The Company own 80% interest, with an option to acquire the remaining 20% from SSR Mining. Located 2.5 hours south of Antofagasta. On September 16, 2020 the company released a CIM compliant Mineral Resource and accompanying NI 43-101 Technical Report (available on SEDAR and on the Companies web page).

Aftermath is well funded to advance its programs in 2021, with $16 million in the treasury.

Qualified Person

Peter Voulgaris, MAIG, MAusIMM, a consultant to the Company, is a non-independent qualified person as defined by NI 43-101. Mr. Voulgaris has reviewed the technical content of this news release, and consents to the information provided in the form and context in which it appears.

ON BEHALF OF THE BOARD OF DIRECTORS

"Ralph Rushton"

Ralph Rushton

CEO and Director

604-484-7855

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

Certain of the statements and information in this news release constitute "forward-looking information" within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to interpretation of exploration programs and drill results, predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward‐looking statements. Although the Company believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward‐looking statements. Factors that could cause actual results to differ materially from those in forward‐looking statements include, but are not limited to, changes in commodities prices; changes in expected mineral production performance; unexpected increases in capital costs; exploitation and exploration results; continued availability of capital and financing; differing results and recommendations in the Feasibility Study; and general economic, market or business conditions. In addition, forward‐looking statements are subject to various risks, including but not limited to operational risk; political risk; currency risk; capital cost inflation risk; that data is incomplete or inaccurate. The reader is referred to the Company's filings with the Canadian securities regulators for disclosure regarding these and other risk factors, accessible through Aftermath Silver's profile at www.sedar.com.

There is no certainty that any forward‐looking statement will come to pass and investors should not place undue reliance upon forward‐looking statements. The Company does not undertake to provide updates to any of the forward‐looking statements in this release, except as required by law.

Cautionary Note to US Investors - Mineral Resources

This News Release has been prepared in accordance with the requirements of Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (''NI 43-101'') and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. securities laws. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian public disclosure standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the "SEC"), and information concerning mineralization, deposits, mineral reserve and resource information contained or referred to herein may not be comparable to similar information disclosed by U.S. companies.